2022.06.21

xx新闻

2022.06.21

xx新闻

Recently, Cospowers New Energy Technology Co., Ltd. (hereinafter referred to as "Cospowers") received a financing of billion yuan, with additional investment from the old shareholders Xingxiang Capital,KPYC Investment and Harvest Capital. The financing funds will be mainly used to support the production line construction of the subsidiary Cospowers.

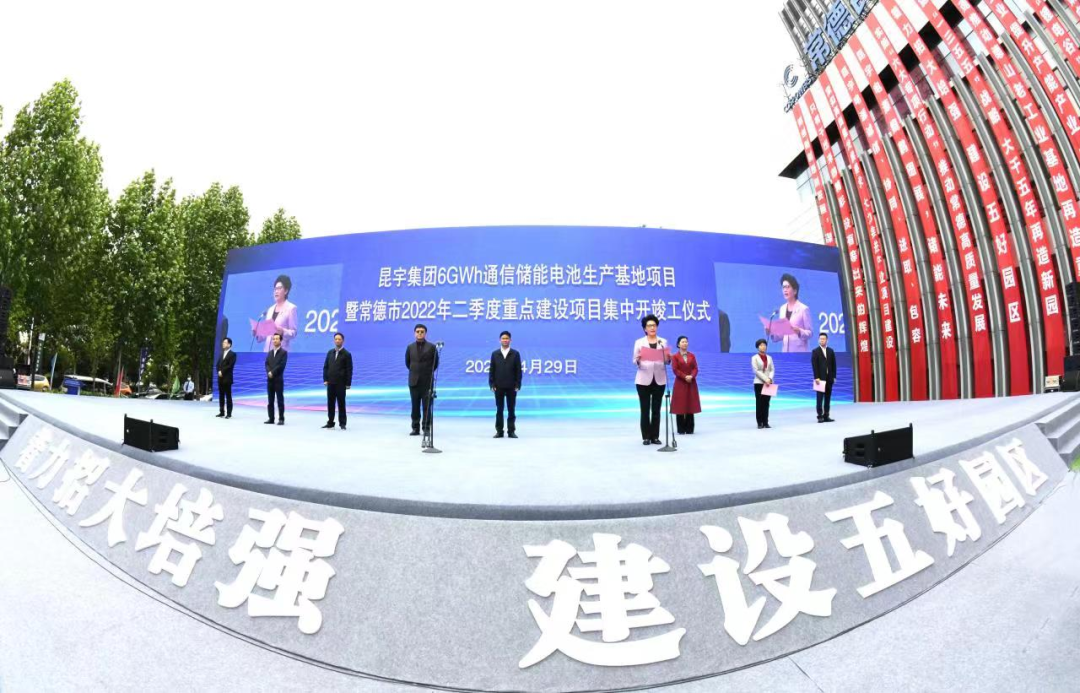

Cospowers will build a full-automatic production line of 6 GWH energy storage lithium batteries in three phases in Changde, Hunan, with an estimated annual output value of more than 6 billion yuan. At present, 0.5 GWH has been put into operation, effectively promoting the development of lithium battery energy storage industry in Hunan Province.

Site of commencement and completion ceremony of key construction projects in Changde in the second quarter of 2022,

On May 12, Cospowers and Xingxiang Capital held an investment signing ceremony in Changde, Hunan.

About Cospowers

Focusing on the international comprehensive industrial development of electrochemical energy storage, Cospowers is the leading enterprise in the domestic energy storage segment. Its main business is the R&D, production and sales of energy storage lithium batteries, which are mainly used for telecommunication energy storage, including base transceiver station energy storage batteries (BTS), small base station energy storage batteries and data center UPS backup batteries. Under the guidance of the national 30/60 dual carbon strategic deployment and the global energy revolution, cospowers has maintained the first place in the global export of telecommunication energy storage lithium batteries for 10 years.

About Xingxiang Capital

Since its establishment, Xingxiang capital has set up and operated 15 funds with a total scale of 30 billion yuan. It has expanded the function of state-owned capital, helped cultivate new industries, and promoted the structural adjustment and layout optimization of state-owned capital. Aiming at the goal of "carbon peaking and carbon neutralization", focusing on the strategic positioning and mission of "Three High and Four New" in Hunan Province, actively promote the in-depth integration of capital and industry, and spare no effort to promote the implementation of the energy conservation and environmental protection new energy industry in the "3+3+2" industrial cluster.

About KPYC Investment

Shenzhen KPYC First Capital Investment has a registered capital of 2billion yuan. Its partners include Shenzhen KPYC Investment t Co., Ltd., First Capital management Co., Ltd., Shenzhen Futian Yindao Fund Investment Co., Ltd., Guangdong Tapai Group Co., Ltd., etc.

The fund focuses on grasping the development potential of strategic emerging industries and the advantages of future industrial transformation, focusing on Shenzhen and strategic emerging industries and future industries supported by national policies such as high-end manufacturing.

About Harvest Capital

Harvest Capitall was founded in 2015. The team has rich experience in equity investment and enterprise management, and focuses on investing in growth enterprises in the field of high-end manufacturing and medical devices. Harvest Capital's fund management scale is nearly RMB 1.8 billion. The fund contributors include government guided funds, listed companies, family offices, private enterprises and high net worth individuals.